On the other hand, costs that add to the property’s value are usually recovered through depreciation. You can write off charges on any maintenance and repair related to your work.

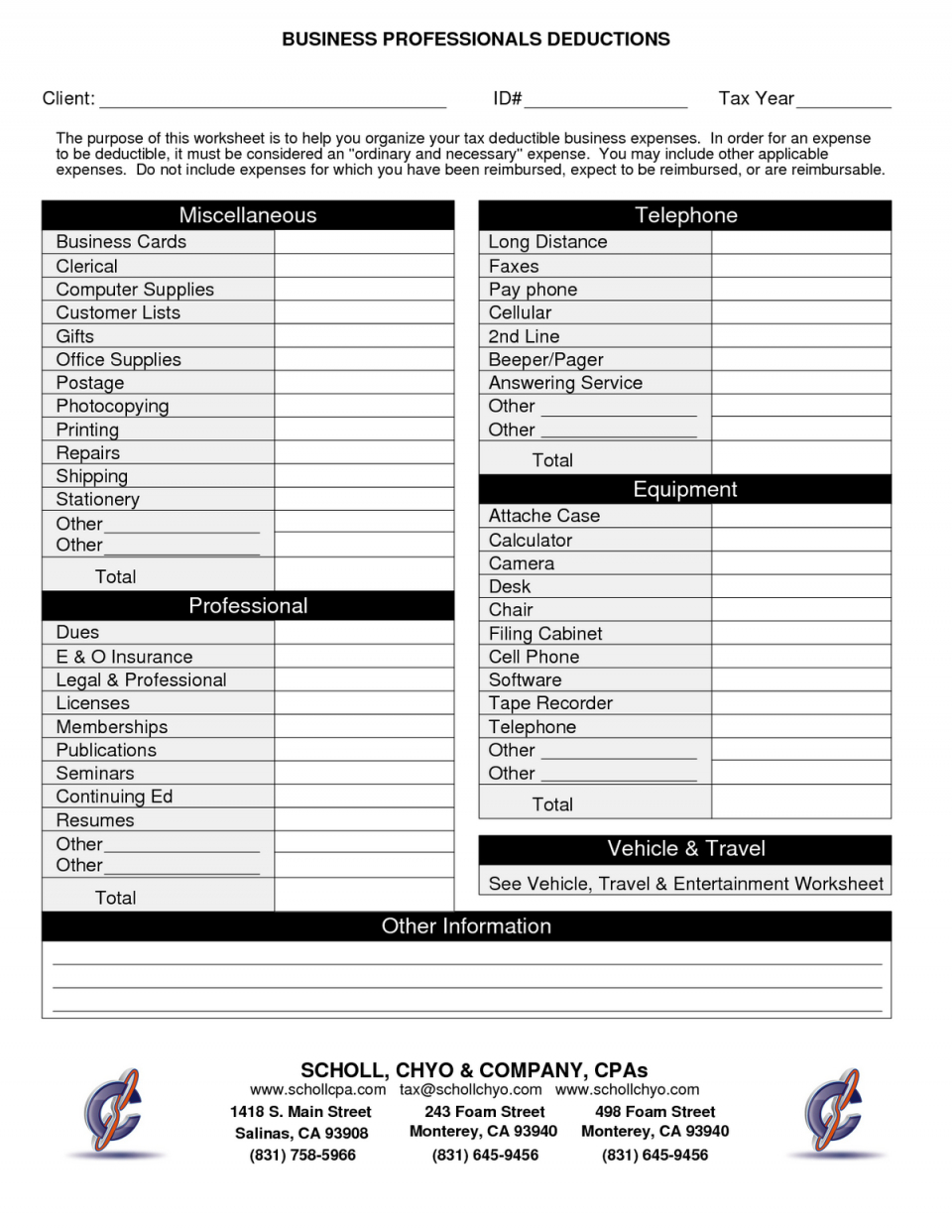

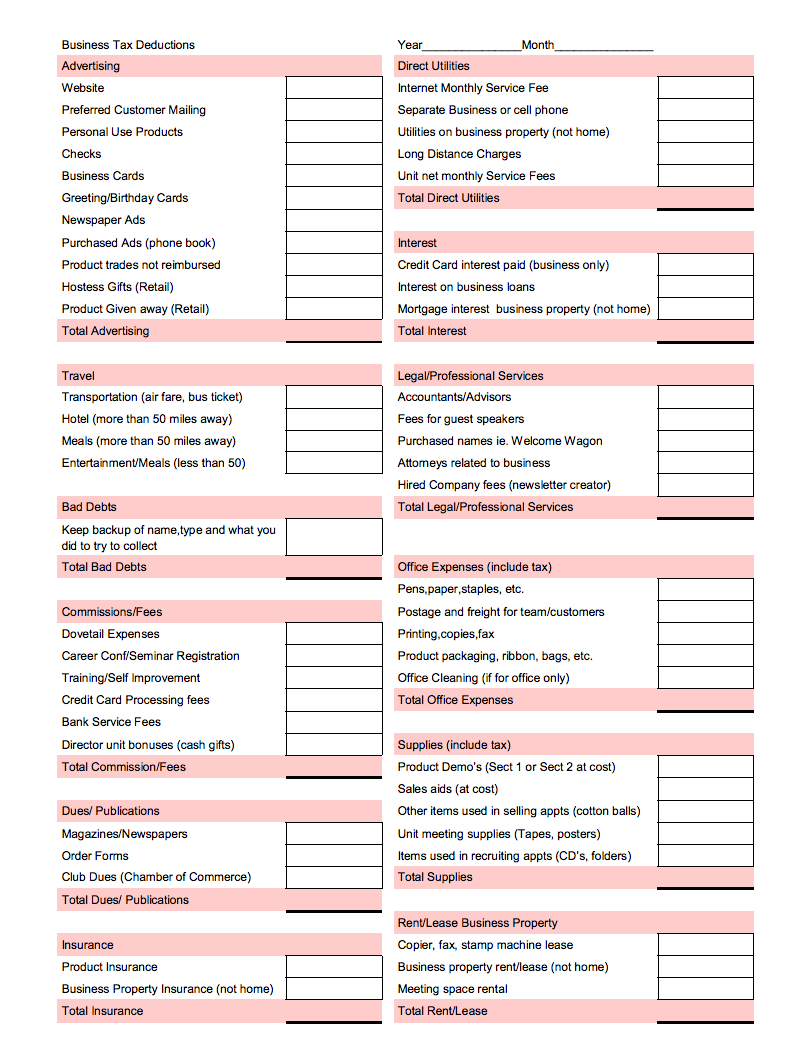

You can fully write off the electricity bill for your facility, and the same goes for your phone bill. Everything you spend on utility bills related to your work is fully deductible. Home office expenses are one of the most common small business deductions. The cost of items used in your job, such as workplace supplies or cleaning supplies for a cleaning service, are all fully deductible. If you, for example, had to book a trip, and you had to reschedule, the airline rescheduling fee, as well as the hotel deposit, is all deductible. If your startup costs in either area exceed 50,000, the amount of your allowable deduction will be reduced by the overage. You can write-off costs of the education and training of your employees, and you can also write-off the cost of your own education if it’s work-related. The IRS allows you to deduct 5,000 in business startup costs and 5,000 in organizational costs, but only if your total startup costs are 50,000 or less. And the seven states in which you can still apply for the write-off are New York, California, Arkansas, Hawaii, Massachusetts, New Jersey, and Pennsylvania. You already know that wages are subject to Social Security and Medicare taxes, together called FICA (Federal Insurance Contributions Act) taxes or payroll taxes since they. Investigative and other costs of starting a business. The IRS allows you to deduct 5,000 in business startup costs and 5,000 in organizational costs, but only if your total startup costs are 50,000 or less. The cost of driving your car for business. If you are a member of the military, and you have to move due to military orders, you can still deduct the charges of your relocation. Small Business Tax Deductions List When youre totaling up your businesss expenses at the end of the year, dont overlook these important business tax deductions. Moving expenses write-off – although this write-off was canceled by the Tax Cuts and Jobs Act in 2017, there are still some situations or states where you can be eligible.If you have separate bank accounts and credit cards tied to your job, all the annual and monthly transfer fees and service charges are deductible. One of the easiest ways to make your business more profitable (without working any harder) is to identify all of your expenses and those that are tax-deductible for your small business. Here are some other minor write-offs on this list that are often overlooked or can be applied in limited circumstances:

0 kommentar(er)

0 kommentar(er)